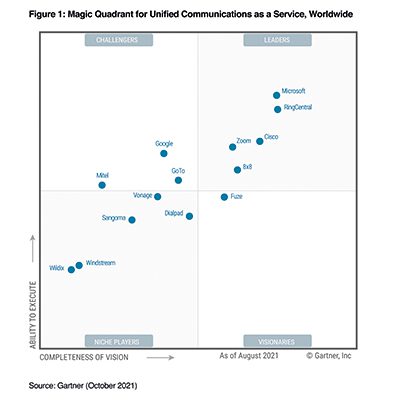

Microsoft Teams has made it into the desired top right hand corner of the Gartner UCaaS magic Quadrant.

Gartner released its UCaaS Magic Quadrant for 2021, showing the market leaders and the ones to watch in the unified communications market for the coming year.

This latest report comes when businesses are embracing the concept of hybrid work and are adapting to what it all means for the businesses culture and employees.

A rapid pace of change is clear with Gartner forecasting 75% of enterprise users globally will not use a desk phone by 2024 – up from just 30% in 2020!

The analyst also predicts that 15% of businesses will rely solely on cloud office suites from Microsoft and Google for their business needs, including telephony in 2022 – up from just 2% in 2019!

Movement in the Magic Quadrant from 2020

Most of the providers from 2020 have remained in the report – even mostly in the same position.

One key change is Alcatel-Lucent Enterprise (ALE) who have been removed from the quadrant.

The removal is probably related to ALE’s agreement with RingCentral, which sees the latter’s tech power Rainbow Office. This partnership was mentioned in the last Magic Quadrant, with Gartner saying that it was announced too late in the year to be taken into consideration for the report. It is worth mentioning that other providers that partner with RingCentral for UCaaS, such as Avaya and Atos, are not included either.

Gartner have not revealed the specifics of why ALE has been removed, only to say that it does not meet the Magic Quadrant’s inclusion criteria. The criteria states that providers must have self-developed, multitenant core UCaaS software which they operate themselves, along with various other user and geography requirements.

Other changes include Sangoma replacing Star2Star, following an acquisition in January 2021 and Wildix joins as the smallest provider in the group by some margin.

Leaders in 2021

8×8

Cisco

Microsoft

RingCentral

Zoom

8×8

8×8 goes to market with its Experience Communications as a Service (XCaaS) offering which includes 8×8 Contact Center, 8×8 Meet, 8×8 Team Messaging and CPaaS.

Gartner noted that 8×8 is geographically diversified, noting its recent increased focus in the UK market.

It was also praised for its integration with Microsoft Teams for UCaaS, CCaaS, and voice.

However, Gartner noted that clients had reported customer service and support inconsistencies during the study period for the Magic Quadrant, resulting in mixed customer satisfaction.

It pointed out that 8×8’s user base growth of 20 percent last year is behind competitors such as RingCentral, Microsoft, and Zoom.

Cisco

Cisco’s Webex has been refreshed this year and now includes functionality for telephony, messaging, collaboration, meetings, and events – as well as a new contact centre offering.

Gartner noted that the last year has seen “unprecedented R&D” and marketing investment pumped into the platform by Cisco, calling Webex’s pace of innovation “among the fastest in the market”.

The analyst declared that Cisco has the most complete self-developed unified comms portfolio in the market when you take into consideration other elements such as devices, SBCs, and networking.

It also highlighted Cisco’s strong channel ecosystem as a positive.

But Gartner also noted Cisco’s relatively late arrival in the UCaaS market, having taken time to rationalise three UCaaS platforms down into the Webex offering it now has. It claimed this led to uncertainty in the market when customers were moving to the cloud, at a time when Microsoft Teams was building momentum.

Gartner said that many Cisco customers with on-prem solutions are now adopting several Microsoft capabilities when moving to the cloud, while channel partners have built out UC practices with competitors such as Microsoft, RingCentral, and Zoom.

Microsoft

Microsoft Teams has been a massive winner during the move to remote and hybrid working, with the most recent data showing 250 million Active Users on Teams and 80 million Active Users on Teams Phone.

Gartner said that adoption of Teams for UC over the past year has “surpassed that of every other provider in this research by more than an order of magnitude”.

Microsoft Calling Plans are proving particularly popular among SMBs, the analyst added, particularly when compared to the more complex Direct Routing option.

In terms of weaknesses, Gartner said that Teams is not “as unified” as options from Cisco and RingCentral – with some customers bemoaning the fact that much of the administrating and provisioning is reliant on PowerShell.

There is also a lack of advanced telephony features such as advanced multiline hunt group capabilities, and advanced queuing and interactive voice response capabilities.

Gartner however said that it has seen no evidence to support the perception that Microsoft’s telephony is unreliable and lacks quality, as many enterprises believe.

RingCentral

RingCentral goes to market with its Message, Video, Phone (MVP) platform, and powers the UCaaS offerings of other providers such as Avaya, ALE, and Unify.

Gartner said that RingCentral has invested heavily in video meetings over the last year and has narrowed the gap between RingCentral Video and competitors such as Cisco, Microsoft, and Zoom.

RingCentral is also in the process of migrating customers from the Zoom-powered RingCentral Meetings platform to its own RingCentral Video, which Gartner said is being well executed.

However, the analyst said that its video platform is still trailing the likes of Zoom and is expected to come under more pressure from bigger brands over the coming year.

Zoom

Zoom’s UC offering was completed by the launch of Zoom Phone in 2019, which rocketed to two million seats earlier this year.

Gartner said that no provider grew quicker than Zoom over the past 12 months, with the exception of Microsoft. It praised Zoom for effectively using the strength of its meeting brand to upsell to telephony.

The firm’s full functionality can be procured easily through Zoom United, which bundles telephony, meetings, and chat in a simple fashion. It also launched Zoom Appliances earlier this year.

Gartner said that Zoom is often overlooked in specialised environments such as healthcare and manufacturing in favour of more tried-and-tested providers, but expects new features to boost its appeal in these areas.

The analyst also noted that, while 80 percent of Zoom Phone deals are transacted direct, Zoom is building out its global channel base to give customers better support.

Challengers in 2021

GoTo

Mitel

Google’s UCaaS offering is made up of Google Chat, Google Meet, and Google Voice, housed in its Workspace collaboration platform – formerly known as G Suite.

Gartner praised Google’s offering for its ease of use, access to its Jamboard for virtual whiteboarding, as well as the quality of its video and calling. It also anticipates huge investment in its platform over the coming years.

Google Voice has also been expanded into Germany, Italy, and Belgium.

However, Gartner said that Google’s telephony capabilities are relatively basic, while Meet is “held back” by its 720p video resolution cap and limited meeting users.

GoTo

GoTo has unified the functionality of GoToConnect, GoToMeeting, GoToWebinar, and GoToTraining into the GoToConnect desktop and mobile app, and also launched a unified admin portal, Gartner said.

The analyst said that GoTo is particularly appealing for organisations that want bundled services beyond UC and into IT support, including functionality such as password management, training, and events.

It also said there is a strong use case for businesses that use Teams but want a deeper set of telephony features.

However, Gartner said that GoTo is not seeing strong adoption in the UK, Europe or APAC.

Mitel

Mitel’s UC offering is made up of MiCloud Connect, which provides telephony and messaging, which can be bought alongside Amazon Chime-powered MiTeam Meetings.

The vendor’s UCaaS operation is focused predominately on North America, the UK, and Australia, with SMBs making up 90 percent of its customer base.

Gartner said that Mitel gets positive feedback when it comes to customer support, as well as its “various paths” to cloud migration which give customers flexibility.

MiCloud Connect is also cheaper than many alternatives.

However, the analyst said that Mitel’s product delivery innovation and PSTN delivery lags behind other UCaaS providers, while MiTeam Meetings lacks some advanced features.

Visionaries in 2021

Fuze

Fuze stands alone in the bottom-right Visionaries corner, with a particular strength in serving organisations with 500-plus users, as well as multinational businesses.

The vendor has also built out specialisations in specific verticals such as manufacturing and transportation.

However, Gartner said that businesses with fewer than 500 users should select another UCaaS provider, while also claiming that large enterprises are unaware of Fuze’s brand and capabilities.

Niche players in 2021

Dialpad

Sangoma

Vonage

Wildix

Windstream

Dialpad

Dialpad’s offering is made up of Talk and Meetings, which together cover telephony, video conferencing, and messaging. The vendor features predominately in the US and Asia and has customers across most market segments.

It announced a partnership with T-Mobile earlier this year, which saw T-Mobile become an investor, channel partner, and customer of its technology. T-Mobile also announced a collaboration offering powered by Dialpad technology, which Gartner says created an opportunity to tap into T-Mobile’s customer base.

Gartner said it believes Dialpad to be among the smaller providers in the report and that, while the acquisition of Highfive has enhanced its Meetings product, it lags behind other video providers.

Sangoma

Sangoma enters the UCaaS Magic Quadrant following its acquisition of Star2Star earlier this year.

The combined company supports telephony, meetings, contact center, SD-WAN, DaaS, trunking, messaging, access control, and CPaaS capabilities, Gartner said, with more than 90 percent of its users based in North America.

The analyst said that Sangoma is well-suited to the midmarket and customers that want to buy bundled IT services.

Gartner added that Sangoma has little brand recognition outside the US and “will be challenged” to build brand awareness in the UCaaS arena.

Vonage

Vonage joined the Magic Quadrant last year through its Vonage Business Communications (VBC) platform.

Gartner said that the firm receives consistently positive feedback and praised it for its intuitive user interface and straightforward administration capabilities.

The analyst added that Vonage has expanded its geographic footprint over the past 12 months but still has immature international service delivery, particularly in APAC.

VBC also integrates with Vonage’s CPaaS and CCaaS offerings.

Wildix

Wildix joins the Magic Quadrant as niche, but disruptive, player. The European provider has strong technical capabilities and have slowly been winning business from larger, less agile, vendors since its inception nearly 20 years ago.

Its sales-oriented solution emphasises WebRTC support which means users don’t have to download desktop clients or browser plug-ins. Wildix’s UC platform and approach makes their solutions incredibly scalable and easy to deploy.

Gartner said that Wildix has broad country-level PSTN replacement services, fulfilled via channel partners.

However, it added that Wildix’s branding can be confusing because of the number of platforms it markets for different use cases, while the emphasis on sales organisations closes it off to broader UCaaS buyers.

Windstream

Windstream delivers telephony, messaging and mobility features through its OfficeSuite UC offering, with operations predominately in the US SMB market.

Since the last Magic Quadrant report, it has launched its “We Will” promotion which features a 100% SLA if the customer is using its SD-WAN. Its OfficeSuite HD Meeting platform is powered by Zoom’s meeting technology.

Gartner said that Windstream is particularly strong in the healthcare, retail and financial services verticals – but lacks general brand recognition in the market and has a limited track record of supporting businesses with more than 1,000 users.

For further information on Unified Communications, Microsoft Teams or Business Phone Systems please contact one of our specialists on 0121 289 4477 or email info@solutions4it.co.uk